The stamp duty on rental units also applies to extension of lease or renewal of the tenancy agreement. Pomona CA- Postponed until 2021.

Laws Of Malaysia Stamp Act Act 378 Online Version Of Updated Text Of Reprint Pdf Free Download

Buy Stamp Act 1949 Act 378 Selected Rules As At 10th October 2020 Seetracker Malaysia

Stamp Duty For Transfer Or Assignment Of Intellectual Property Koo Chin Nam Co

Chantilly VA- Postponed until 2021.

Stamp act malaysia. There are two types of Stamp Duty namely ad valorem duty and fixed duty. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. The Malaysian Inland Revenue Board MIRB has issued Guidelines on the application for stamp duty relief.

The tenancy agreement will only come into effect once the stamp duty has been paid and all the relevant stamps and seals are in place. In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. How to stamp my Tenancy Agreement.

Here is the current status of our 2020 shows. So far I have been only 3 LHDN offices namely. This is a unique computer generated stamp having a unique identification number through which any member country of The Hague convention can check its authenticity online.

Stamp duty on short-term and long-term leases are different from state to state. Prepared two copies of Tenancy Agreement and duly signed by both Tenant and Landlord. While for this Article the Stamp Act 1949 hereinafter referred to as the Stamp Act governed payment of stamp duty in relates to the acquisition of properties in Malaysia.

A number of Orders in respect of the Income Tax Act 1967 and Stamp Act 1949 have also been gazetted. A 3022021 dated 12 July 2021 stamp duty exemptions are given for residential properties which are sold during the period between 1 June 2020 to 31 May 2021 and 1 June 2021 to 31 December 2021. The Digital Signature Act 1997 DSA 1997 which came into force on 1st October 1998 with the purpose of regulating the use of digital signature in Malaysia ensures the security of legal issues related to electronic transactions and verifies the use of digital signatures through certificates issued by licensed Certification Authority CA.

How is the stamp paper value for a rent agreement determined. Stamp duty in Singapore is a type of tax that all homeowners must be familiar with. Stamp duty exemption on instrument of agreement for a loan or financing in relation to a Micro Financing.

Franking Machine and Revenue Stamp will be replaced by receiptstamp certificate which generate by STAMPS. STAMPS is an Electronic Stamp Duty Assessment and Payment System via internet. A 3012021 and Stamp Duty Exemption No5 Order 2021 PU.

Irving TX- Postponed until 2021. Depending on the type of property transaction you will encounter Buyers Stamp Duty BSD Sellers Stamp Duty SSD Additional Buyer Stamp Duty ABSD or stamp duty for rental properties. The cover required is in respect of legal liability for death or bodily injury to third party excluding passengers.

MIRBs Guidelines on the Application for Stamp. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. Learn how to calculate stamp duty from a trusted source with PropertyGuru Finance and use our reliable calculator.

Buyers will be sent this in an email sometime after Access Canberra has received the transfer instrument written document. ACT payable within 28 days of settlement purchasers must pay stamp duty within 14 days of receiving a Notice of Assessment from Access Canberra. Who is required to use STAMPS.

Stamp duty is not subjected to GST An instrument relating to the sale and purchase of retail debenture and retail sukuk as approved by the Securities Commission under the Capital Markets and Services Act. A 2172020 dated 28 July 2020 or Stamp Duty Exemption No4 Order 2021 PU. The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord.

The stamp duty shall be remitted to the maximum of RM 200. This method will replace the manual system in LHDNM s counter which use Franking Machine and Revenue Stamp. An instrument is defined as any written document and in general stamp duty is levied on legal commercial and financial instruments.

The stamp duty is free if the annual rental is below RM2400. A passport stamp is an inked impression in a passport typically made by rubber stamp upon entering or exiting a territory. Stamp Duty Land Tax is a tax paid to HMRC when you buy houses flats and other land and buildings over a certain price in the UK.

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. In general term stamp duty will be imposed to legal commercial and financial instruments. The tax is also paid by buyers from overseas non-UK residents at a 2 surcharge when buying property in the UK.

A postage stamp is a small piece of paper issued by a post office postal administration or other authorized vendors to customers who pay postage the cost involved in moving insuring or registering mail who then affix the stamp to the face or address-side of any item of mailan envelope or other postal cover eg packet box mailing cylinderthat they wish to send. Passport stamps may occasionally take the form of sticker stamps such as entry stamps from JapanDepending on nationality a visitor may not receive a stamp at all unless specifically requested such as an EU or EFTA citizen travelling to an EU or EFTA country Albania. The duration of the agreement also plays a role.

Stamp duties are imposed on instruments and not transactions. This Policy is hardly ever written by Insurers. Apostille stamp is a square shaped computer generated sticker stamp pasted on reverse of the document by the Ministry of External Affairs Government of India.

The stamp duty for a tenancy agreement in Malaysia is calculated as the following. This brings UK Chancellor Rishi Sunaks emergency support for the residential property market in England and Northern Ireland which was introduced in July 2020 to an end. This stamp duty is paid to the Inland Revenue Authority of Singapore IRAS.

Stamp duty is a tax on legal documents in Malaysia. This is the minimum cover corresponding to the requirements of the Road Transport Act 1987. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income of any person accruing in or derived from Malaysia or received in Malaysia from outside Malaysia.

Stamp duties are imposed on instruments and not transactions. Stamp duty exemption on loanfinancing agreements executed from 1 January 2022 to 31 December 2026 between MSMEs and investors for funds raised on a peer-to-peer P2P platform registered and recognised by the Securities Commission Malaysia. Current Status of our Shows.

Paul MN- Postponed until 2021. Stamp Duty Tax Calculator - 20212022 Updates 01102021 The taper period for the stamp duty holiday has now ended. Under both the.

Thank you for your interest in Stamp Scrapbook Expo. Go to your nearest Lembaga Hasil Dalam Negeri office which is the same place where we submit our income tax. Stamp duty fees are typically paid by the buyer not the seller.

An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. Puyallup WA- Postponed until 2021. Stamp duty in key tier-2 cities in India.

Milwaukee WI- Postponed until 2021. Pleasanton CA- Postponed until 2021. Some examples of documents where stamp duties are applicable include your Tenancy Agreement Instrument of Transfer and Loan Agreements.

Location is the prime factor when it comes to estimating the stamp paper value.

Bakermckenzie Com

Lo Chambers Here Is How You Calculate Your Stamp Duty Facebook

Stamp Duty Notes Pptx Bkat3033 A Specialised Taxation Group 10 Stamp Duty No Name 1 2 3 4 Aishah Binti Mat Isa Tay Yih Thern Hwong Boh Sien Course Hero

Stamp Laws Of Malaysia Reprint Act 378 Stamp Act Pdf Free Download

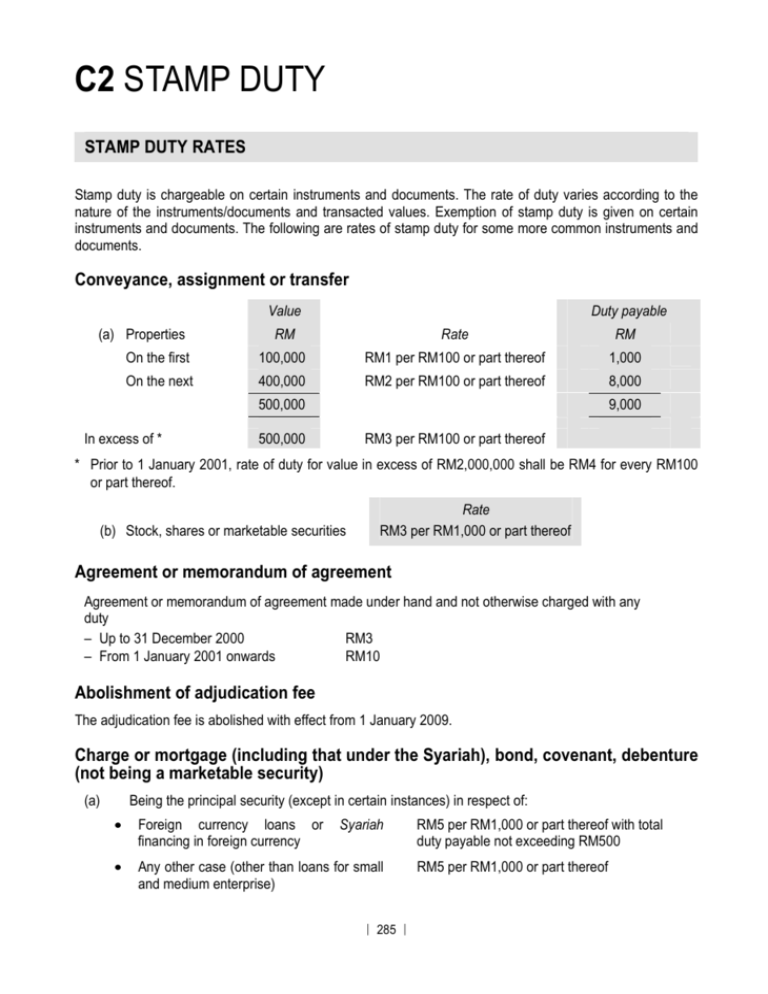

C2 Stamp Duty The Malaysian Institute Of Certified Public

Buy Stamp Act 1949 Act 378 Selected Rules As At 10th October 2020 Seetracker Malaysia

Proposed Ad Valorem Stamp Duty To Be Paid When Contract Signed Publication By Hhq Law Firm In Kl Malaysia

Stamp Act 1949 Act 378 Selected Rules As At 15th June 2021 Shopee Malaysia